I would describe myself as a sceptical investor. It usually takes a lot of research before I am convinced. Surrey real estate convinced me. Surrey properties are currently the most affordable real estate investment in Metro Vancouver. We have been looking after a number of properties in Surrey and the prospect of owning a brand new condo in Metro Vancouver starting from mid 300 thousand intrigued me. I decided to take a close look at the numbers and consequently, I did end up purchasing a property. Please read on to discover why.

Reason 1: The Bang for the Buck

I believe that Surrey condos are currently the best real estate investment available in Metro Vancouver, but don’t take my word for it. Let the numbers do the talking. For the purpose of this article I have used statistics for 1 bedroom condos. The source for the sales data is Stats Centre of Real Estate Board of Greater Vancouver. The source for the average rental rates data is the Housing Market Information Portal of Canada Mortgage and Housing Corporation.

For the comparison I have chosen Burnaby, Coquitlam, New Westminster, Richmond and Vancouver.

Why these cities?

These are the cities that are connected by SkyTrain. SkyTrain is arguably the most convenient and fastest way to travel by public transit in the Lower Mainland.

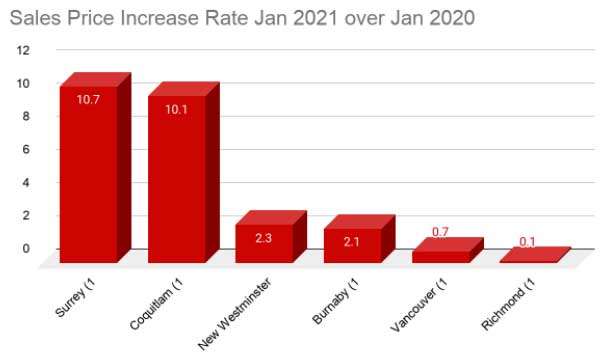

Sales Price Increase

The chart below shows the increase in the sales price of one-bedroom condos in the cities with sales prices in January 2021 compared to January 2020. As you can see, Surrey’s 1 bedroom has seen the highest rate of increase closely rivaled by only Coquitlam.

SOURCE: statscentre

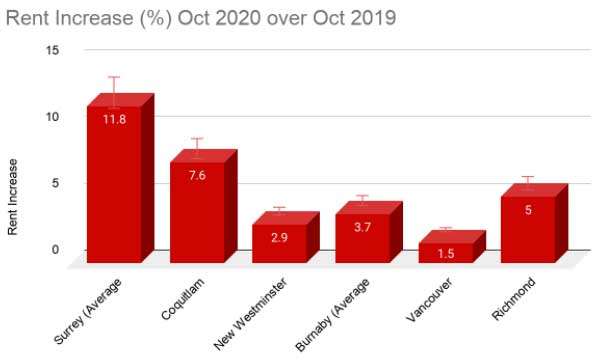

Rental Rate Increase

Here we are comparing the rate of increase of average rent for a 1 bedroom home in Oct 2020 compared to Oct 2019 (the most current data available from CMHC). In this category the City of Surrey is the clear winner. Surrey’s rate of increase is even more impressive when we consider the impact the ongoing pandemic has had on the rental market.

SOURCE: CMHC & SCHL

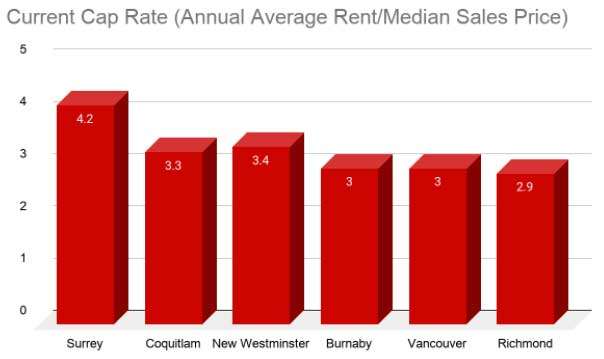

Cap Rate

Cap rate or Capitalization rate is the rate of return on a real estate investment property based on the income the property is expected to generate. Let’s think of it as an interest on your money in the bank. The number might not appear very high, but please keep in mind that this number does not take into account the appreciation in the value of the property. When we combine the two together, the return on investment based on the rental income plus the appreciation in the value of the property, Surrey yields an impressive 14.9% return on investment (10.7% increase in the property value, plus 4.2% capitalization rate). If the rental rates continue to rise at the same rate the return is just going to get better.

SOURCE: CMHC & SCHL

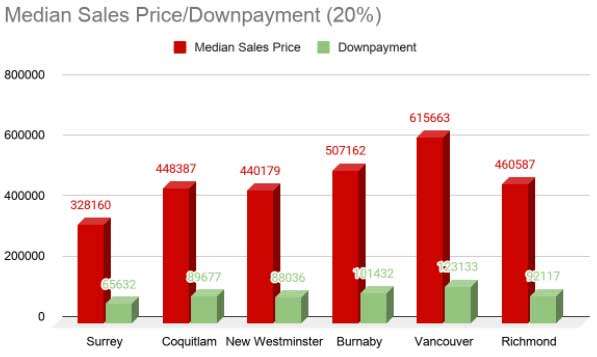

Reason 2: Affordability – The Most Affordable Real Estate Investment in Metro Vancouver

Surrey does not only have the highest rate of increase in both rental rates and sales prices among the chosen cities but it is also the most affordable. And it is not close.

Surrey is easily the most affordable real estate market among cities connected to Downtown Vancouver by SkyTrain. In January 2021 the median sales price of Surrey 1 bedroom condo was $328,160, the cheapest among the chosen cities followed by New Westminster at median price of $440,179 for a 1 bedroom condo. That is a difference of $112,019! To put it in perspective for you, if you would purchase a condo in New Westminster at the media price and would put 20% down, you would need $22,404 extra for the down payment!

Obviously it gets only worse when you compare Surrey to the more expensive cities in this study. The good news is that you might not need 20% to get into the Surrey real estate market. Many developers offer ownership of condos in presales with just 10% deposit or the option to pay the deposit over one year. The beauty of purchasing in a presale is that you do not need to come up with the rest of the money until the project completes which is usually 2 to 5 years after paying the deposit. The value of your property continues growing with the real estate market and at the same time you do not have to make any mortgage payments.

After the completion Surrey real estate might be one of the very few investments where you will be generating a positive cash flow from the rental income or at least break even. Just for comparison a mortgage payment on a $260,000 loan at a mortgage rate of 2.14% over 30 years is $1,072 per month. New one bedroom condos in Surrey are currently renting for about $1,450. The remaining funds after the payment of the mortgage should be more than enough to cover your strata fees and property tax. If you invest in Vancouver you will need a mortgage loan of about $490,000 which comes to a monthly payment of about $2,003 dollar at the same mortgage rate. In the current market, you could rent such a 1 bedroom condo for about $2,000 a month which means that you will certainly pay for some of the expenses out of your pocket.

Let’s have a look at one more table. I have compared Surrey to the cities in this study in terms of affordability. To compare two investments we are comparing the purchase price and the rental income the property generates. If a property is for example 10% more expensive, it should generate 10% more rental income in order to generate the same return. We are comparing Surrey 1 bedroom median purchase price of $328,160 and Surrey 1 bedroom average rent of $1,140 to the other areas in Metro Vancouver. The Rental Income needed is the rental income amount you would need to generate per month to realize the same return as in Surrey. The Cashflow Deficit per month is the dollar value of the difference between the rental income needed and the actual average rental income.

| Purchase Price 1 Bed | Price Difference ($) | Price Difference (%) | Additional Downpayment | Average Rental Income 1 Bed | Rental Income Needed | Cashflow Deficit per month | |

| Surrey vs New Westminster | $440,179 | $112,019 | 34% | $22,404 | $1,230 | $1,529 | -$299 |

| Surrey vs Coquitlam | $448,387 | $120,227 | 37% | $24,045 | $1,217 | $1,558 | -$341 |

| Surrey vs Burnaby | $507,162 | $179,002 | 55% | $35,800 | $1,263 | $1,762 | -$499 |

| Surrey vs Vancouver | $615,663 | $287,503 | 88% | $57,501 | $1,515 | $2,139 | -$624 |

| Surrey vs Richmond | $460,587 | $132,427 | 40% | $26,485 | $1,313 | $1,600 | -$287 |

SOURCE: CMHC & SCHL

Reason 3: The Potential or What we Learned from Olympic Village

While a number of cities in Metro Vancouver chose to anchor communities by a mall (think Metrotown, Brentwood or Oakridge just to name a few), I will argue that malls bring a very little value to the community, besides creating a number of low paying jobs.

Surrey chose a different approach. Surrey is investing into its future. Surrey brought to the city, Innovation Boulevard, the health technology accelerator created in partnership with Simon Fraser University. The objective of the institute is to accelerate the commercialization of health technologies. The Innovation Boulevard accelerator currently supports over 40 health technology companies and has facilitated the commercialization of six products in just in the last two years.

Simon Fraser University opened their Surrey campus in 2019. It is offering more than 30 undergraduate and graduate degree programs and there are 8,000+ students attending the programs at the Surrey campus.

It surely seems that Surrey is on the right track to build a vibrant community in its city’s centre and rival arguably the only other downtown district in Lower Mainland, Vancouver’s Downtown. The CEO of Innovation Boulevard said about the city: “Surrey has innovation built into their DNA”

There is a lot to like about Surrey and people are starting to recognize that.. Surrey is the 3rd fastest growing city in Canada. Every month 1000 people move to Surrey and Surrey is expected to become BC’s largest city by 2041.

Why is Surrey real estate cheaper?

By now you must be asking yourself this question. It is a fair question and it is one difficult to answer. There might be a number of reasons, but one more obvious than the others is criminality. Surrey gets a lot of negative press because of the crimes that are taking place in the city. Every large city has to deal with crime and Surrey took a step in the right direction by establishing its own police department, the Surrey Police.

In Vancouver we have seen many neighbourhoods struggling with high crime rates tarnishing their reputation and damaging its real estate values. We have seen the neighbourhoods struggling and we have seen the neighbourhoods overcome the challenges. The change was driven mostly by real estate development.

Do you remember the struggles of Olympic Village? The sales were so bad that the developer could not make loan payments and went into receivership. The city was forced to step in to secure the funding and It wasn’t until 2010 when the Aquilini Group bailed out the city by purchasing the last 67 units for 91 million that the city was able to pay off the $630 million loan.

Today Olympic village is one of the most sought after neighbourhoods in Vancouver and its struggles are all but forgotten. If you were one of those investing in Olympic Village I am sure you have seen your investment grow quite significantly.

The lesson we can learn from the Olympic village is that a neighbourhood is not desirable until it is. The key to successfully invest into real estate is recognizing the potential of a developing area and Surrey has plenty of it.

If you are interested in learning more about Surrey investment opportunities I will be happy to chat with you!